Choosing the right accounting software is a critical decision for any small business. Effective accounting software can streamline your financial management processes, save time, and improve accuracy, ultimately contributing to the overall health and growth of your business. At BBA Tax, we understand the importance of making informed decisions when it comes to managing your finances. With our expertise in bookkeeping, corporate taxes, personal taxes, CRA audit defense, incorporation, and financial management services, we’re here to guide you through the process of selecting the best accounting software for your small business.

Understanding Your Business Needs

Before diving into the myriad of accounting software options available, it’s crucial to first understand your business’s specific needs. This involves assessing the complexity and volume of your financial transactions, your industry-specific requirements, and your budget for accounting solutions. Here are some key considerations:

- Business Size and Growth Stage: A startup might have different needs compared to an established business. Consider your current size and projected growth to choose a software that can scale with your business.

- Industry Requirements: Some industries have unique accounting needs. For example, retail businesses might need robust inventory management, while service-based businesses might focus more on invoicing and time tracking.

- Budget Constraints: Determine how much you can afford to spend on accounting software. Keep in mind that while some solutions may have a higher upfront cost, they might offer long-term savings through increased efficiency.

- User-Friendly Interface: Ensure that the software is easy to use, especially if you or your staff do not have an extensive accounting background.

- Integration Capabilities: Check if the software integrates well with other tools you use, such as CRM systems, payroll software, and banking platforms.

- Support and Training: Consider the level of customer support and training provided by the software vendor. Good support can be invaluable, especially during the initial setup phase.

Key Features to Look For

When evaluating accounting software options, look for features that align with your business needs. Here are some essential features to consider:

- Core Accounting Functions: Ensure the software can handle basic accounting tasks such as bookkeeping, invoicing, accounts payable and receivable, and bank reconciliation.

- Financial Reporting: Look for robust reporting capabilities that provide insights into your financial performance. Customizable reports can help you track key metrics and make informed decisions.

- Inventory Management: If you manage inventory, choose software that offers comprehensive inventory tracking and management features.

- Tax Preparation and Compliance: The software should help you manage your tax obligations, including generating tax reports and ensuring compliance with tax regulations.

- Payroll Management: If you have employees, consider software that includes payroll processing, tax calculations, and employee record management.

- Multi-User Access: Ensure the software supports multiple users with varying levels of access. This is important if different team members need to access and update financial data.

- Cloud-Based vs. Desktop: Decide whether you prefer a cloud-based solution, which offers flexibility and remote access, or a desktop solution, which might offer more robust features but limited accessibility.

Popular Accounting Software Options

There are numerous accounting software options available, each with its strengths and weaknesses. Here, we highlight some of the most popular choices for small businesses:

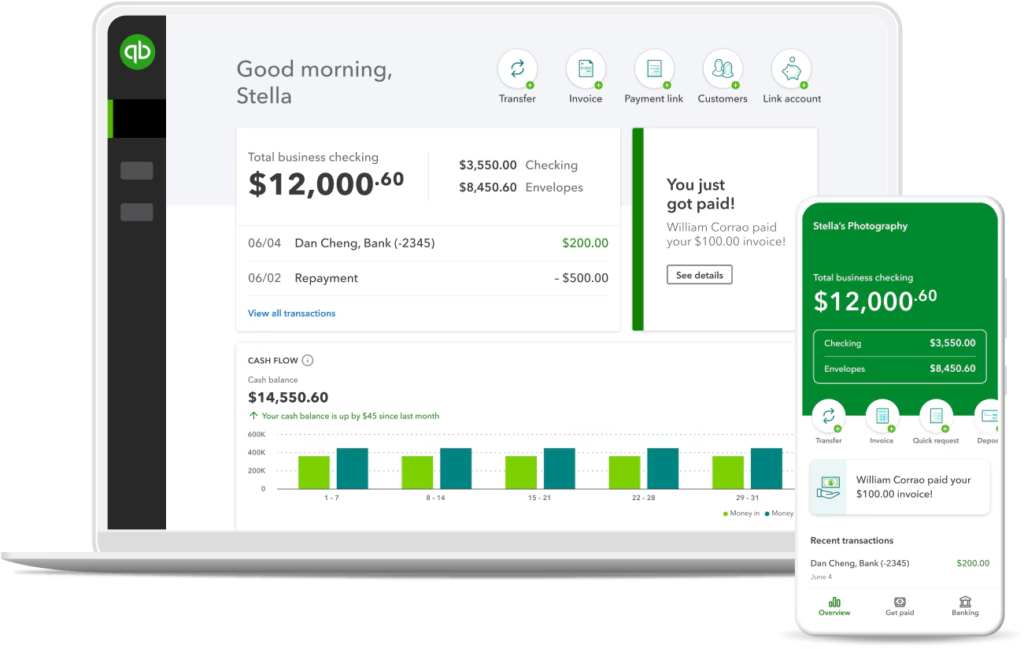

1. QuickBooks

Overview: QuickBooks is one of the most widely used accounting software solutions for small businesses. It offers both cloud-based and desktop versions, catering to various business needs.

Features:

- Comprehensive bookkeeping and accounting functions

- Invoicing and payment processing

- Expense tracking and management

- Financial reporting and dashboards

- Payroll integration

- Tax preparation tools

- Multi-user support

Pros:

- User-friendly interface

- Scalable solutions for different business sizes

- Extensive third-party integrations

Cons:

- Can be expensive, especially for advanced features

- Customer support can be inconsistent

–

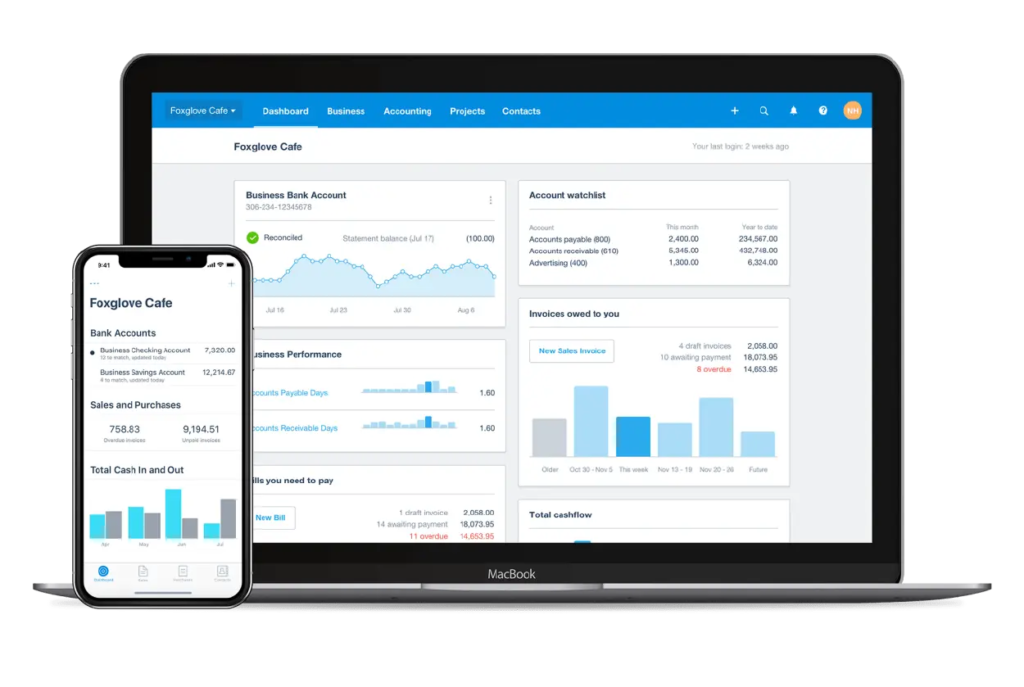

2. Xero

Overview: Xero is a cloud-based accounting software designed for small businesses, known for its intuitive interface and strong feature set.

Features:

- Real-time financial reporting

- Inventory management

- Invoicing and expense tracking

- Bank reconciliation

- Multi-currency support

- Payroll integration

Pros:

- User-friendly and easy to set up

- Excellent customer support

- Strong integration capabilities

Cons:

- Limited functionality for larger businesses

- Can be pricey for additional users

–

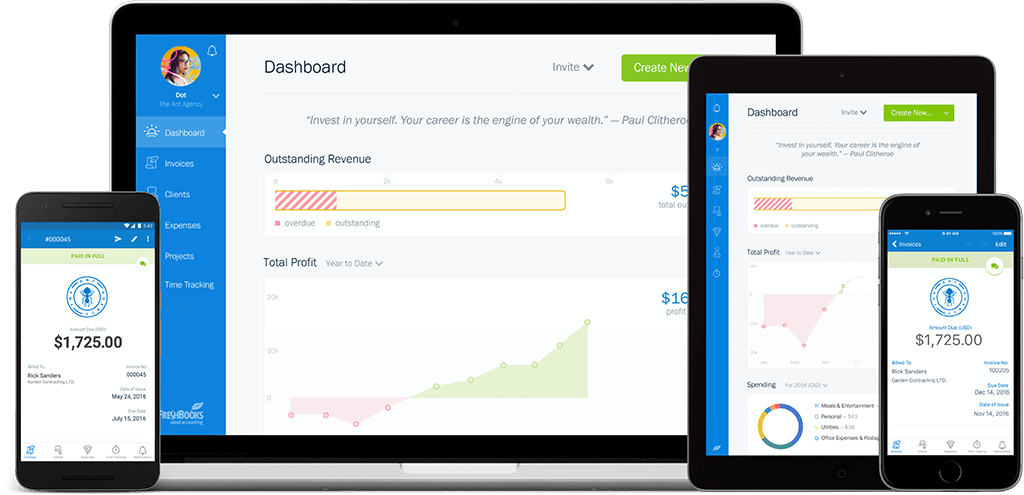

3. FreshBooks

Overview: FreshBooks is a cloud-based accounting software ideal for service-based businesses and freelancers. It emphasizes ease of use and invoicing capabilities.

Features:

- Invoicing and payment processing

- Time tracking and project management

- Expense tracking

- Financial reporting

- Multi-user support

Pros:

- Simple and intuitive interface

- Excellent customer support

- Affordable pricing for small businesses

Cons:

- Limited inventory management features

- Not as robust for larger businesses

–

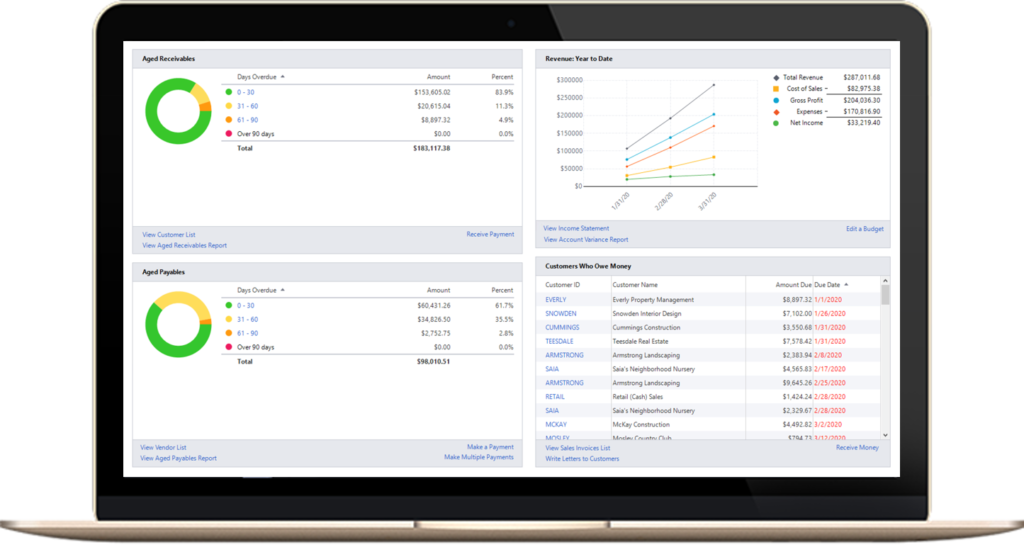

4. Sage 50cloud

Overview: Sage 50cloud is a hybrid solution that combines desktop software with cloud capabilities. It’s suitable for small to medium-sized businesses.

Features:

- Comprehensive accounting functions

- Invoicing and payment processing

- Inventory management

- Payroll processing

- Financial reporting

- Integration with Microsoft Office 365

Pros:

- Robust feature set

- Strong reporting capabilities

- Reliable customer support

Cons:

- Can be complex to set up and use

- Higher cost compared to other options

–

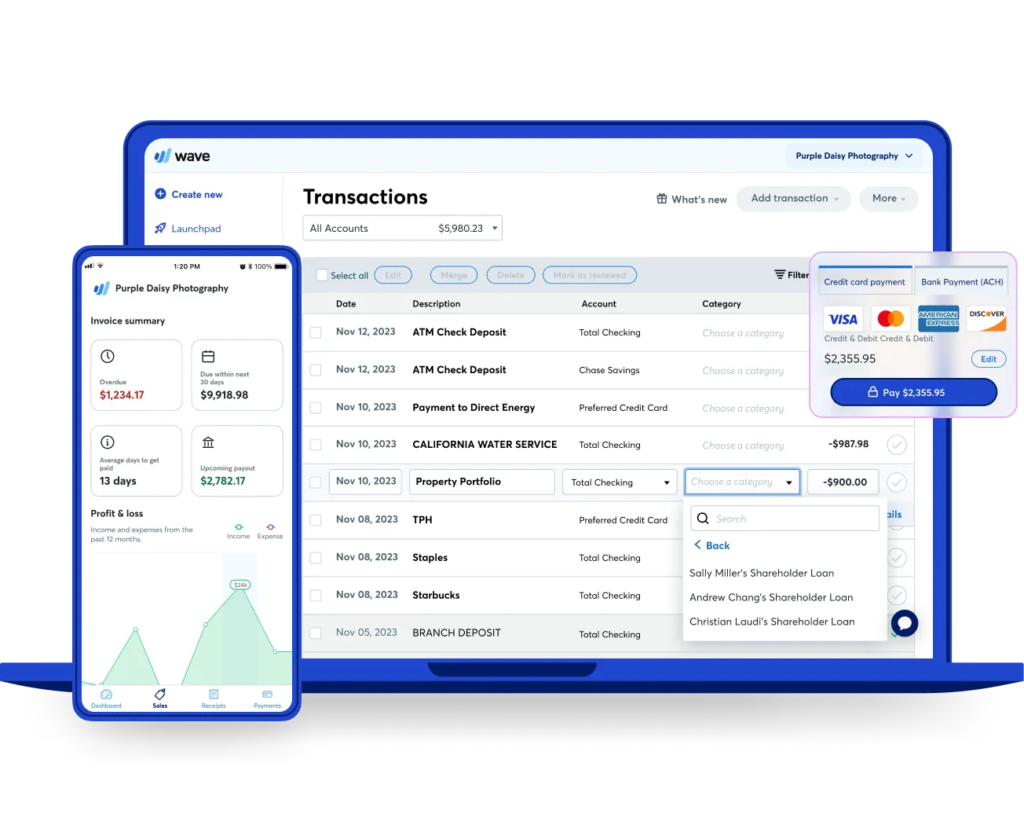

5. Wave

Overview: Wave is a free, cloud-based accounting software ideal for small businesses and freelancers. It offers a range of features at no cost.

Features:

- Invoicing and payment processing

- Expense tracking

- Financial reporting

- Payroll (paid add-on)

- Receipt scanning

Pros:

- Free to use

- User-friendly interface

- No hidden costs

Cons:

- Limited features compared to paid options

- Customer support is primarily through email

–

Steps to Choose the Right Accounting Software

To ensure you select the best accounting software for your small business, follow these steps:

1. Assess Your Needs

Identify the specific accounting tasks you need the software to perform. Consider your business size, industry, and any unique requirements.

2. Set a Budget

Determine how much you are willing to spend on accounting software. Keep in mind that more expensive options may offer advanced features that can save you time and money in the long run.

3. Research and Compare Options

Research different accounting software options and compare their features, pricing, and customer reviews. Create a shortlist of software that meets your needs and budget.

4. Take Advantage of Free Trials

Many accounting software providers offer free trials. Take advantage of these to test the software’s functionality and user interface. Assess how well it meets your business needs.

5. Evaluate Integration Capabilities

Ensure the software integrates well with other tools you use, such as your CRM, payroll software, and banking platforms. Seamless integration can save you time and reduce errors.

6. Consider Customer Support

Evaluate the level of customer support offered by the software provider. Reliable support can be invaluable, especially during the initial setup phase and when you encounter issues.

7. Read Reviews and Testimonials

Look for reviews and testimonials from other small business owners. This can provide insights into the software’s strengths and weaknesses, as well as the provider’s customer service quality.

8. Make an Informed Decision

Based on your research and testing, choose the accounting software that best meets your needs, fits your budget, and has positive reviews from other users.

–

Implementation and Training

Once you’ve chosen your accounting software, the next step is implementation. Here are some tips for a smooth transition:

1. Plan the Implementation

Create a detailed plan for implementing the software, including a timeline and key milestones. Assign responsibilities to team members and ensure everyone understands their roles.

2. Data Migration

If you’re transitioning from another accounting system, plan for data migration. Ensure all financial data is accurately transferred to the new software.

3. Train Your Team

Invest time in training your team to use the new software. Many providers offer training resources such as tutorials, webinars, and documentation. Ensure everyone is comfortable with the software’s features and functions.

4. Monitor and Adjust

After implementation, monitor the software’s performance and gather feedback from your team. Make any necessary adjustments to ensure the software is meeting your business needs.

–

Conclusion

Choosing the right accounting software is a crucial decision that can significantly impact your small business’s financial health and efficiency. By understanding your business needs, evaluating key features, researching options, and planning a smooth implementation, you can select a solution that supports your growth and success. At BBA Tax, we are committed to helping small businesses in Ottawa and across Canada make informed decisions about their financial management. Whether you need assistance with bookkeeping, corporate taxes, personal taxes, CRA audit defense, incorporation, or financial management, our team of experts is here to support you. Contact us today to learn more about how we can help you achieve your business goals.

–

Additional Resources

For more information on choosing the right accounting software and managing your business finances, check out these resources:

- BBA Tax Blog: Stay updated with the latest tips and insights on accounting and financial management.

- QuickBooks Tutorials: Learn how to get the most out of QuickBooks with step-by-step guides and tutorials.

- Xero Learning: Access a wealth of resources and training materials to master Xero accounting software.

- FreshBooks Support: Find helpful articles and support resources for using FreshBooks.

- Sage 50cloud Help: Explore tutorials and guides for using