Table of Contents

- Introduction: Contractors and Tax Challenges

- Understanding Taxes for Contractors in Canada

- Track All Eligible Business Expenses

- Incorporation vs Sole Proprietorship

- Pay Yourself Strategically: Salary vs Dividends

- Use Registered Accounts to Reduce Taxable Income

- Plan for GST/HST Obligations

- CRA Compliance and Audit Considerations

- Benefits of Professional Tax Support in Ottawa

- Year-Round Tax Planning Checklist for Contractors

- Conclusion: Maximize Income, Minimize Tax

1. Introduction: Contractors and Tax Challenges

Contractors in Ottawa face unique tax challenges. Unlike employees, they manage their own income, expenses, and tax remittances. Without proper planning, contractors can end up paying more than necessary.

At BBA Tax, we help contractors reduce their tax burden through strategic planning, proper bookkeeping, and CRA-compliant deductions, ensuring maximum take-home pay.

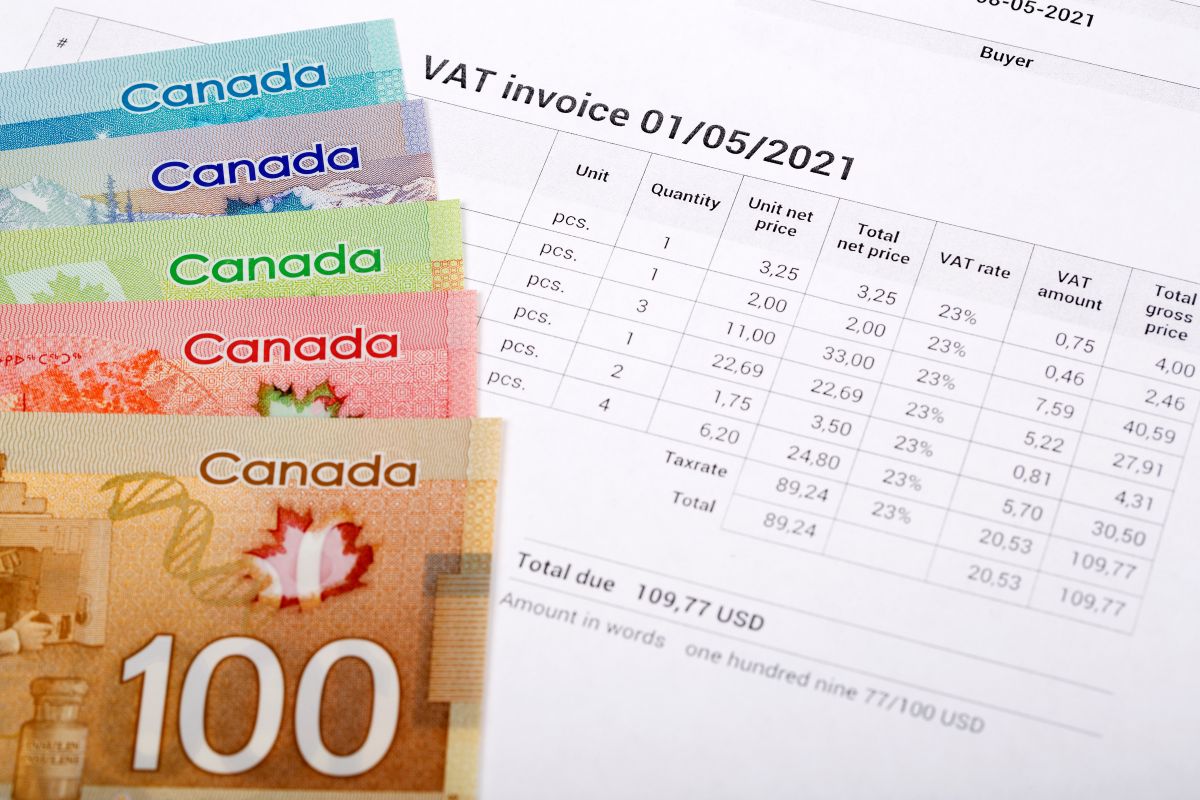

2. Understanding Taxes for Contractors in Canada

Contractors are usually considered self-employed, meaning they’re responsible for:

- Income tax on business and personal earnings

- CPP contributions on self-employment income

- GST/HST collection and remittance (if over $30,000 in revenue)

Taxes are calculated on net income, so maximizing deductions is critical.

3. Track All Eligible Business Expenses

Deductible expenses directly reduce taxable income. Common contractor deductions include:

- Office rent and utilities (home-office portion if applicable)

- Supplies, tools, and equipment

- Vehicle costs (gas, maintenance, insurance)

- Internet, phone, and software subscriptions

- Professional fees (accountants, legal advice)

- Training or certifications

Tip: Keep receipts and detailed records — the CRA can request proof during an audit.

4. Incorporation vs Sole Proprietorship

Many contractors benefit from incorporating their business:

- Lower small-business tax rate on profits (~12.2% in Ontario 2025)

- Ability to defer taxes by retaining earnings in the corporation

- Limited liability protection

- Potential for income splitting with family members

A sole proprietorship is simpler but often results in higher personal tax rates. Consult an accountant to see which structure suits your goals.

5. Pay Yourself Strategically: Salary vs Dividends

If incorporated, contractors can choose how to pay themselves:

Salary:

- Deductible to the corporation

- Contributes to CPP and RRSP room

Dividends:

- Taxed at a lower rate personally

- No CPP contributions

A blended approach often minimizes total taxes while keeping retirement contributions intact.

6. Use Registered Accounts to Reduce Taxable Income

Registered accounts can reduce or defer taxes:

- RRSPs: Contributions reduce taxable income immediately

- TFSAs: Growth is tax-free and withdrawals aren’t taxed

- RESPs: Tax-sheltered education savings for children

Properly timing contributions and withdrawals can significantly reduce your 2025 tax liability.

7. Plan for GST/HST Obligations

If your business earns over $30,000, you must register for GST/HST:

- Collect tax from clients

- Remit to CRA quarterly or annually

- Claim input tax credits for GST/HST paid on business purchases

Proper planning prevents penalties and ensures maximum deductions.

8.CRA Compliance and Audit Considerations

The CRA monitors self-employed individuals closely. Common triggers for audits include:

- Large or unusual deductions

- High expenses relative to revenue

- Inconsistent income reporting

BBA Tax Ottawa helps contractors maintain accurate records, file on time, and defend against audits, reducing risk and stress.

9. Benefits of Professional Tax Support in Ottawa

Working with BBA Tax provides:

- Personalized tax planning for contractors

- Maximum deduction and credit identification

- CRA audit defense and guidance

- Ongoing bookkeeping and financial advice

Professional support ensures contractors pay only what’s necessary, legally.

10.Year-Round Tax Planning Checklist for Contractors

- Track all receipts and expenses monthly

- Separate personal and business accounts

- Review RRSP and TFSA contribution limits

- Schedule quarterly tax payments

- Consult an accountant before large purchases

- Keep updated records for CRA compliance

- Review income-splitting and dividend strategies

11. Conclusion: Maximize Income, Minimize Tax

Contractors in Ottawa can significantly reduce their tax burden with proper planning, bookkeeping, and professional guidance.

By tracking expenses, choosing the right business structure, paying yourself strategically, and using registered accounts wisely, contractors can keep more of their hard-earned money while staying compliant with CRA regulations.

📞 Contact BBA Tax Ottawa today to schedule your contractor tax consultation and start maximizing your income legally.

BBA Tax – Ottawa’s trusted accounting firm for contractors, personal tax, corporate tax, and CRA audit defense.