As a self-employed professional in Canada, managing your tax return can feel complex and overwhelming, especially with the unique rules and deductions available only to self-employed individuals. With detailed guidance, however, you can approach tax season with confidence, reduce your tax burden, and avoid the risk of penalties for errors or missed deadlines. This comprehensive guide will walk you through everything you need to know about filing your tax returns as a self-employed individual, helping you understand deductions, important deadlines, and essential tips to keep your finances organized.

Table of Contents

- Understanding Your Tax Obligations as a Self-Employed Individual

- Important Tax Deadlines for Self-Employed Individuals in Canada

- How to Keep Your Financial Records Organized

- Claiming Business Expenses: Maximizing Your Deductions

- How to Calculate Your Taxable Income

- What Forms You Need for Filing as Self-Employed

- Tips for Filing Your Self-Employment Taxes Accurately

- Common Mistakes to Avoid When Filing as Self-Employed

- Benefits of Hiring a Tax Accountant in Ottawa

- How BBA Tax Can Help You with Your Self-Employed Tax Needs

1. Understanding Your Tax Obligations as a Self-Employed Individual

In Canada, self-employed individuals are responsible for reporting their business income on their personal tax returns. You’ll need to pay income tax, Canada Pension Plan (CPP) contributions, and potentially Goods and Services Tax/Harmonized Sales Tax (GST/HST) if your revenue exceeds $30,000. Unlike salaried employees, taxes aren’t withheld from your income, so it’s crucial to plan for these payments throughout the year.

Filing taxes as self-employed involves reporting all sources of income, which could include freelancing, consulting, gig work, or small business revenue. Knowing what constitutes business income versus personal income will help you maintain an accurate return.

2. Important Tax Deadlines for Self-Employed Individuals in Canada

As a self-employed individual, your filing deadline differs slightly from that of salaried employees. Here are the key dates to remember:

- Tax Filing Deadline: June 15th. However, if you owe taxes, you still need to pay by April 30th to avoid interest on any balance due.

- Quarterly Instalments: If you anticipate owing more than $3,000 in taxes for the year, you may need to pay quarterly installments.

Missing deadlines can lead to penalties and interest, so it’s important to plan ahead. Setting up a schedule with reminders or automating payments can help ensure timely submissions.

3. How to Keep Your Financial Records Organized

Maintaining organized records is one of the most important aspects of successful tax filing for self-employed individuals. Keep detailed records of:

- Income: Track all incoming payments, including invoices and receipts.

- Expenses: Keep receipts for deductible expenses, like office supplies, utilities, and travel costs.

- Bank Statements: Maintain a separate business bank account to simplify tracking of income and expenses.

- Mileage Logs: If you use your vehicle for business, keep a log of mileage used for work purposes.

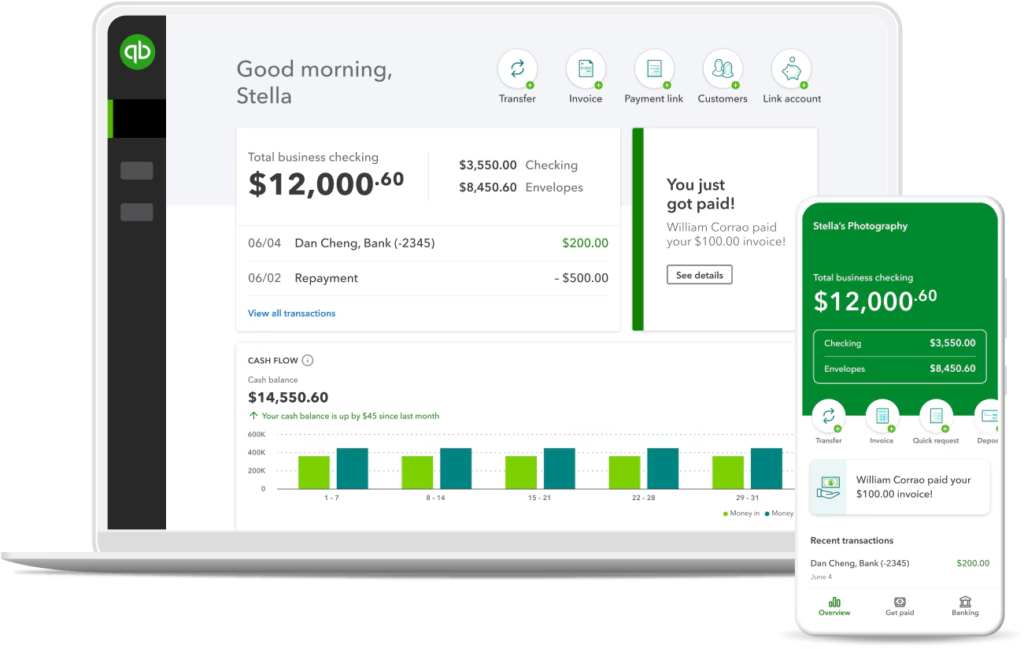

Using accounting software, such as QuickBooks or FreshBooks, can streamline the process. An accountant specializing in self-employed tax returns can also provide guidance on maintaining accurate records, which can help minimize errors and maximize deductions.

4. Claiming Business Expenses: Maximizing Your Deductions

Self-employed individuals have access to a variety of tax deductions that reduce taxable income. Here are some common deductible expenses:

- Home Office Expenses: You may claim a portion of your home’s utilities, rent/mortgage interest, and insurance.

- Vehicle Expenses: Costs like gas, maintenance, and insurance are deductible if the vehicle is used for business.

- Professional Fees: Expenses like accounting or legal fees related to your business are deductible.

- Office Supplies: Items like pens, paper, computers, and phones used for business purposes.

- Advertising and Promotion: Marketing expenses, including online ads, website fees, and printed materials.

Be sure to keep all receipts and records to substantiate these deductions, as they can be essential during audits.

5. How to Calculate Your Taxable Income

Your taxable income is calculated by subtracting your business expenses from your gross income. Here’s a simplified example:

- Determine Gross Income: This is the total income you received for the year.

- Subtract Eligible Expenses: Deduct any allowable business expenses, like home office and vehicle costs.

- Resulting Amount: The remaining amount is your taxable income.

Remember, income from all sources must be reported, even if you’ve received payments in cash. The Canada Revenue Agency (CRA) emphasizes full income disclosure, and inaccuracies can lead to penalties.

6. What Forms You Need for Filing as Self-Employed

Self-employed individuals in Canada typically need the following forms:

- Form T2125 – Statement of Business or Professional Activities: This form helps you report business income and expenses.

- Form T1 – General Income Tax and Benefit Return: The main tax form for reporting all personal and business income.

- GST/HST Returns: If your business is GST/HST registered, you’ll need to file regular returns.

Completing these forms accurately is essential for compliance. A tax professional can help ensure all necessary information is included and properly reported.

7. Tips for Filing Your Self-Employment Taxes Accurately

Filing accurately and avoiding common mistakes can save you from unnecessary stress and penalties. Here are some tips:

- Double-Check All Numbers: Ensure calculations for income and expenses are accurate.

- Use Accounting Software: Tools like QuickBooks simplify calculations and improve accuracy.

- Keep Separate Accounts: Avoid mixing personal and business finances.

- Save for Taxes: Set aside a portion of each payment received to cover taxes.

- Consult an Accountant: An Ottawa accountant can guide you through the process, ensuring compliance and accuracy.

8. Common Mistakes to Avoid When Filing as Self-Employed

Errors in your tax return can lead to delays, penalties, or even audits. Here are some common pitfalls to avoid:

- Not Reporting All Income: The CRA expects full disclosure of all income.

- Misclassifying Expenses: Make sure expenses meet CRA’s criteria to be deductible.

- Claiming Non-Business Expenses: Personal expenses are not deductible.

- Missing Deadlines: Late filings lead to penalties and interest.

By working with a tax professional, you can reduce the likelihood of these errors and ensure a smoother filing experience.

9. Benefits of Hiring a Tax Accountant in Ottawa

While it’s possible to handle your taxes alone, hiring a tax accountant can save time, reduce errors, and potentially lower your tax burden. Here’s how an accountant can help:

- Expertise: A self-employed tax accountant understands the unique deductions and requirements for freelancers and business owners.

- Time Savings: Managing business finances is time-consuming; an accountant allows you to focus on your business.

- Audit Support: If you’re audited, an accountant can represent you and ensure your records meet CRA standards.

- Optimized Deductions: A tax accountant knows how to maximize deductions legally, lowering your tax liability.

10. How BBA Tax Can Help You with Your Self-Employed Tax Needs

At BBA Tax, we specialize in helping self-employed professionals in Ottawa manage their tax obligations efficiently. Our dedicated team is experienced in filing for freelancers, consultants, gig workers, and small business owners, ensuring that you take full advantage of deductions and avoid costly mistakes.

Our services include:

- Bookkeeping: Keep your financial records accurate and organized.

- Tax Preparation and Filing: Ensure accurate and compliant tax filings.

- Expense Optimization: Maximize deductions and minimize tax liabilities.

- Audit Support: Representation and support if the CRA audits your return.

With BBA Tax, you can approach tax season with confidence, knowing your finances are in expert hands.

Conclusion

Managing taxes as a self-employed individual in Canada comes with unique challenges and responsibilities. By understanding your tax obligations, keeping organized records, and working with a knowledgeable accountant, you can simplify the process, reduce your tax burden, and avoid penalties. BBA Tax is here to help self-employed individuals in Ottawa with comprehensive tax services tailored to meet the unique needs of self-employed professionals. Contact us today to learn how we can assist with all your tax and accounting needs.